Green shipping's future: Strategic partnership between public and private finance

By Dr Li HongyanFor Singapore to retain leadership in green shipping, it must harness private finance alongside public funds.

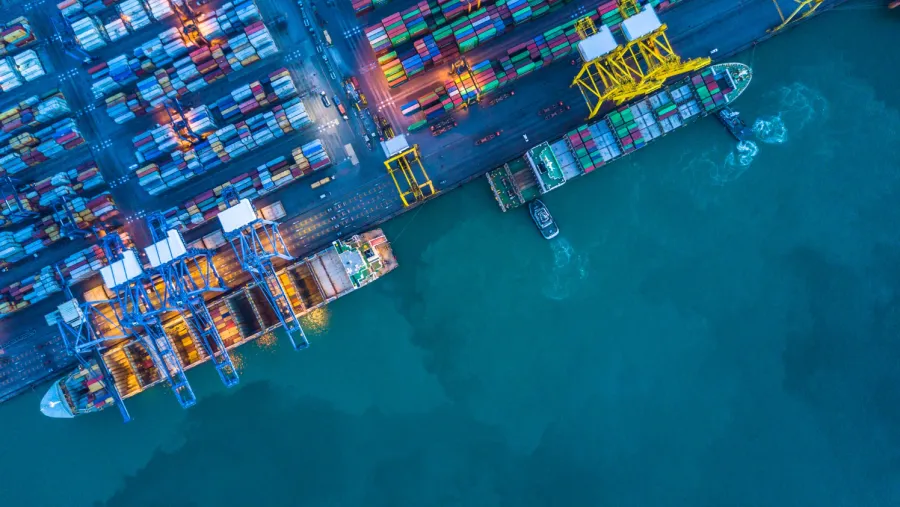

Singapore’s position as a global maritime hub places it at the forefront of shipping’s decarbonisation journey.

Whilst the International Maritime Organisation's (IMO) 2050 net-zero strategy provides a clear direction, the financial pathway is formidable. Public funds and government grants are vital to kick-start the transition, but they cannot cover the immense capital expenditure required. Unlocking private capital and innovation will be indispensable.

The future of green shipping depends on a strategic partnership between public and private finance.

International shipping remains overwhelmingly fossil-fuelled and carbon-intensive. In 2022, it produced around 2% of global energy-related CO₂, and in 2021, it consumed roughly 8.7 exajoules of energy—almost all from oil-based fuels. These realities make decarbonising the sector urgent, not optional.

The IMO now charts an ambitious path to net-zero GHG emissions by around 2050, with indicative checkpoints of at least 20% by 2030 and at least 70% by 2040 versus 2008. However, it is as much economic as it is technological. Low-emission fuels like sustainable biofuels, green ammonia, and green hydrogen remain costly and scarce, with underdeveloped supply chains and limited quality assurance.

The Global Maritime Forum estimates that $1.28t to $1.79t (US$1.0t to US$1.4t, approximately US$50 to US$70b per year) is required to halve shipping emissions by 2050; aligning with the IMO’s net-zero ambition increases the total to $1.79t to $2.43t (US$1.4t to US$1.9t).

This financing must fund the entire value chain, from onshore fuel production to port infrastructure, not only vessels.

The cost premium is striking even at the micro level. A new dual-fuel vessel typically costs 20% to 40% more than a conventional ship, adding $19.24m to $38.4m (US$15m to US$30m) to the price of a large container ship.

Retrofitting engines or installing dual-fuel conversion kits can lower the outlay, but the expense remains substantial. This "green premium" is far too high for any single company to absorb. Without support, firms face risks from new policies and stranded assets, as vessels become uneconomic before the end of their service life.

Public support is essential to make first-mover projects bankable. Revenues from carbon pricing, grants, and fee relief can be combined with concessional and commercial finance to create viable projects.

EU ETS revenues illustrate the power of public finance in action. The EU ETS began covering maritime on 1 January 2024, with the first allowance surrender due in September 2025 for 2024 emissions.

The system raises substantial capital— $60.57b (US$47.2b) in 2023 (from $65.44b) and US$42b in 2024 (from €38.8b)—with proceeds flowing to Member States and EU decarbonisation funds. Through the Innovation Fund, around 20 million allowances (≈US$1.73b at ~US$86.6 per allowance) are earmarked through 2030 specifically to support maritime decarbonisation.

These funds will support projects across the value chain—fuel production and uptake of renewable or low-carbon fuels, vessel and port upgrades, and enabling infrastructure—at a meaningful scale. Since 2023, Member-State auction revenues have been ringfenced for climate and energy purposes, a mandate that now explicitly includes shipping and ports.

The Maritime and Port Authority (MPA) of Singapore has committed $50m (US$39m) for supporting the implementation of its Maritime Singapore Green Initiative (MSGI), which includes funds supporting projects and studies supporting decarbonising the port, as well as concessions on fees and taxes for ships adopting clean fuels.

Relying solely on public funds is unrealistic. Many countries lack carbon-pricing regimes, and where such systems exist, prices remain far below EU ETS levels. At the global level, key design elements for the IMO’s proposed Net-Zero Fund—including allocation rules and eligible uses—are yet to be finalised.

Meanwhile, in many developing economies, limited fiscal space further constrains the ability to finance a long-term transition from general budgets.

First-of-a-kind Synthetic Zero-Emission Fuel (SZEF) supply chains face technology, demand, safety-code, and offtake risks that commercial lenders price harshly. Private investors’ hesitancy to fund such projects isn’t anti-climate; it’s an aversion to unpriced risk.

Blended finance provides a bridge by aligning public intent with private risk-adjusted returns.

Singapore’s Financing Asia’s Transition Partnership (FAST-P) aims to secure $6.4b (US$5b) in commitments, comprising $1.28b (US$1b) in concessional capital and $5.13b (US$4b) in commercial capital. Within FAST-P, the Green Investments Partnership (GIP) has reached a first close of $653.75m (US$510m) early this September, enabling it to begin operations and deploy capital to de-risk green infrastructure projects across Southeast and South Asia.

In parallel, the Asian Development Bank has launched the Sustainable and Resilient Maritime Fund to accelerate decarbonisation in the maritime sector, including critical port infrastructure.

Beyond finance, assurance is also maturing. The Singapore-headquartered Global Centre for Maritime Decarbonisation recently delivered the world’s first field validation of physical tracer technologies for marine biofuels, demonstrating a practical anti-fraud verification method. This is exactly the kind of integrity signal financiers need for book-and-claim and receivables finance.

Corporations are also mobilising finance to gain a first-mover advantage. The Green Shipping Fund (GSF), a $589m (US$460m) private debt fund, provides tailored financing for both eligible new and existing vessels aimed at cutting emissions.

In Asia, NYK Line (Nippon Yusen Kabushiki Kaisha) has issued a transition bond to fund decarbonisation projects, including LNG-fuelled vessels and related upgrades. Similarly, Mitsui O.S.K. Lines has developed a comprehensive Sustainable Finance Framework, raising capital through transition-linked loans and leveraging Japan’s performance-based interest-subsidy scheme under the Act on Strengthening Industrial Competitiveness.

To conclude, public funding can provide critical momentum, but it cannot anchor maritime decarbonisation alone. The capital requirements demand deeper collaboration.

For Singapore to retain leadership in green shipping, it must harness private finance alongside public funds. True progress depends on risk-sharing partnerships that combine public credibility with private expertise and capital.

Only by blending these forces can the industry steer through this transition and achieve a sustainable, net-zero future by 2050.